Cash Flow Management

The generator needs fuel to keep on running. In this day and age, this concept of needing fuel to keep the generator running is not something unheard of and many business owners can relate to that. Thanks to Eskom I can use our need to explain the cash flow concept. Just like the generator needs fuel to keep the business operating, the business needs cash to be able to pay the employees, suppliers, and other expenses, thus keeping the business operating.

Sometimes I think it is easier to fill up a can of diesel than to collect payment for the goods and services provided, especially if the business does not operate on a cash basis. You need to protect the cash flow of the business at all times to be able to save for those dark days and to have enough to keep operating.

Hopefully, the generator has a gauge to indicate the fuel level. But when managing cash flow, we need more than just a bank balance.

You need metrics to track the cash flow, thus helping make timeous business decisions. I am not talking about litres but business metrics. So, what are business metrics? It is a quantifiable measure to track, monitor, and assess the success or failure of business processes. Each business owner decides on the set of metrics to use that makes sense for the business, for example, inventory metrics mean nothing if you are selling services. A Key Performance Indicator on the other hand specifically targets certain areas to measure performance.

Metrics that can be used in managing the cash flow are leads, conversions, average sales, repeat purchases, cash on hand, accounts payable, and account receivable. The amount of leads impacts the sales levels and the time debtors take to pay the accounts impacts the cash on hand and the ability to pay employees and accounts due. Clearly, a knock-on effect that can be measured and managed. A cash flow cycle is measured in days. The number of days to convert a lead to a sale, to receive payment, and to pay accounts due. Thus reducing the number of days in the cycle results in more efficiency in managing the cash flow.

There are a few strategies to impact the cash flow cycle. The first is to get a quick yes from the client and to deliver the service or goods as fast as possible.

The second is to have payment terms. Remember payment terms actually mean something if you actively follow up on outstanding invoices. If you keep avoiding calling on customers for payment, they will not pay until you follow up and the impact is that you do not have the cash to operate the business. Implement strategies to promote quick and easy payment, such as deposits, retainers, and debit orders.

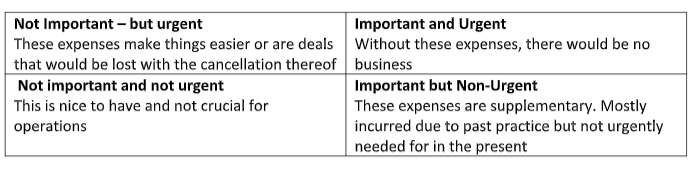

The third is to revisit the expenses. If not done already, divide the fixed cost, e.g. rent, telephone, salaries, insurance, etc., and the costs that are directly related to the volume of work, thus the variable costs. The perception is that the variable cost automatically follows work volume, but it is not always the case. Leslie Hassler suggests the variable cost be prioritized by urgency following the Einstein Matrix.

I suggest you follow this model for all expenses because we tend to get carried away in good times and without realizing it places an additional burden on the cash flow.

Now is the time for the reality check. How many days of cash on hand do you need, after you implemented the above strategies?

Divide the monthly expenses by the number of days in a month to determine the daily cash need. The divide the bank balance by the daily cash need to get the estimated days of cash on hand. Ideally, you must be able to provide for at least 3 cash flow cycles. And that is the reality check! Do you have enough cash on hand to provide for a cash flow cycle? Business owners often think that they must have all the answers, and that is just a perception! Engage with your team or a mentor to assist with ideas to shorten the cash flow cycle and to implement new processes. Just like the generator that can not run on fumes, a business cannot survive without cash flow management.